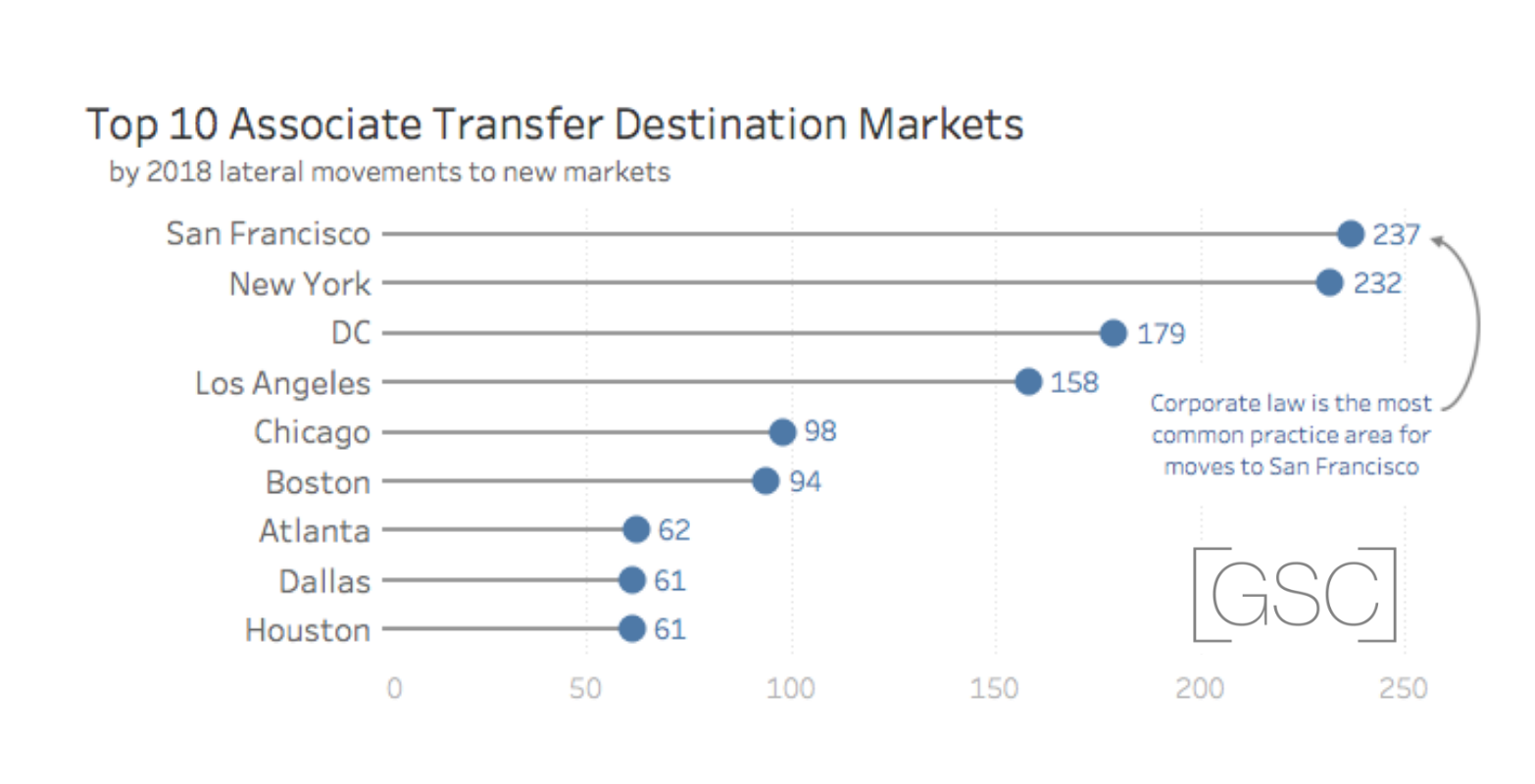

The need for associates working with startups/emerging companies and venture capital funds is high, especially across the Bay Area, New York and Boston legal markets. Firms well-known for this type of practice, such as Goodwin, Wilson Sonsini, Cooley and Gunderson Dettmer, have offices in all three markets and open junior and mid-level associate needs across the board.

Startup businesses cross multiple industries - of course there are "apps" and related computing technology services, but there is also insurtech, fintech and block chain/crypto-currency, and startups in the health care and life sciences space. Lawyers at major law firms that work in an emerging company practice represent the growing number and variety of startups "from start to finish" - from the formation as a small company to the company's private sale or public offering. Similarly, major law firms are fighting for the legal work at \ of the venture capital funds that put rounds of funding into these emerging companies and need lawyers to run the agreements and represent their interests.

Many firms that have strong emerging company practices have relatively lean entry-level associate classes, so when the market is "hot" and there's a need for more talent, they look to the larger number of general corporate-trained associates in markets like New York City.

So how can you successfully lateral into the exciting world of working with startups and venture capitalists on their transactional issues? Here are some tips:

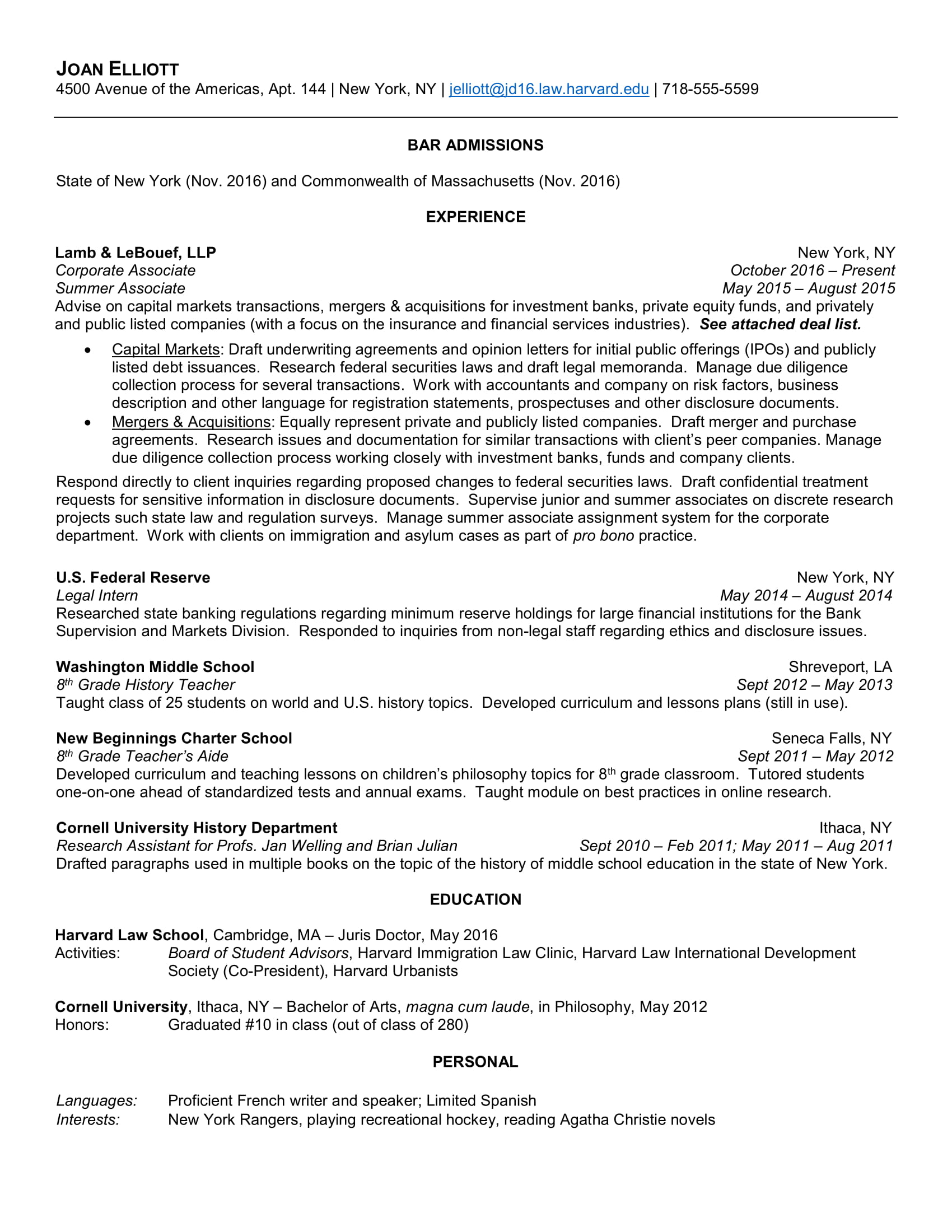

Get as much technology client experience as possible. If you're in a capital markets, M&A or banking and finance practice, chances are that much of your work is for financial industry clients (especially if you are in NYC). Take opportunities to work on deals that touch on the technology industry in some way, even if the client is more established and not a startup. Attorneys that work with emerging companies like to hire people that have a demonstrated interest and connection to the technology industry.

Focus on financing agreement drafting and corporate governance skills - the more experience, the better. If you are coming from a capital markets or M&A practice, the deals are large and the work is varied - diligence, prospectus drafting, dozens of ancillary agreements. Unlike many large public and private companies, emerging companies are in a constant state of structural change and rounds of funding. Focus on getting experience in drafting different types of financing agreements and answering governance questions, event if the assignments are "one-off" and separate from your day-to-day deal work.

Be prepared to take a possible "class year cut." Even if you focus on getting and demonstrating the right skills for an emerging company practice, a firm may ask that you take a "class year cut" if your previous corporate practice was too different. This means that if you were a 4th year associate at your previous firm, you may start as a 3rd year associate at your new firm. (Though firms can also offer the opportunity to "catch up" to your actual class year if you demonstrate your abilities.)